How to Get an EIN for My LLC: Complete Guide 2025 with Processing Time & Methods

Thinking of launching a new startup, LLC, or nonprofit organization in the U.S.? One of the first steps you should take is learning how to get an EIN for my LLC. This unique number, issued by the IRS, works like a Social Security Number for your business. It’s critical for taxation, opening a business bank account, and hiring employees. But many entrepreneurs ask: how long does it take to get an EIN?

In this guide, we’ll break it down clearly so you understand both how to get an EIN for my LLC and how long it typically takes, depending on the method you choose.

What Is an EIN and Why Is It Important?

An EIN (Employer Identification Number), also called a Federal Tax Identification Number, is assigned by the IRS to uniquely identify your business. You’ll need one if you:

- Hire employees

- Operate as a partnership or corporation

- Run an LLC with more than one member

- Have a Keogh plan (a retirement plan for self-employed individuals)

- Need to file employment, excise, or alcohol/tobacco/firearms tax returns

- Open a business bank account

Even if you’re a sole proprietor, knowing how to get an EIN for my LLC helps separate your personal and business finances for tax and legal clarity.

Methods of Applying: How to Apply for EIN Online, by Fax, Mail, or Phone

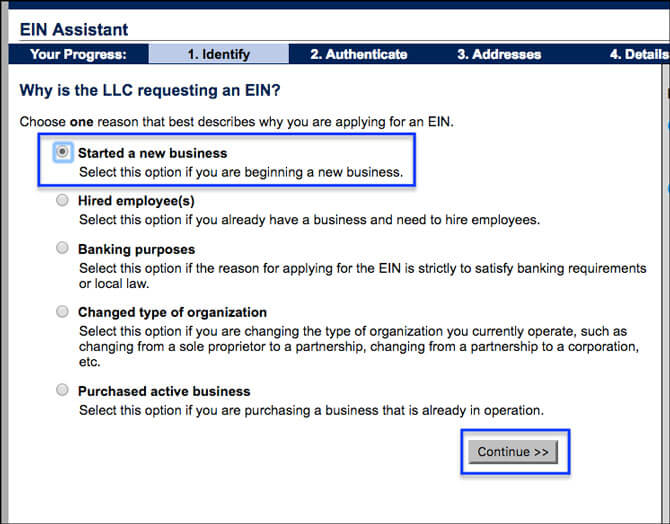

Understanding the different methods is key to knowing how to get an EIN for my LLC efficiently. There are four main ways to apply:

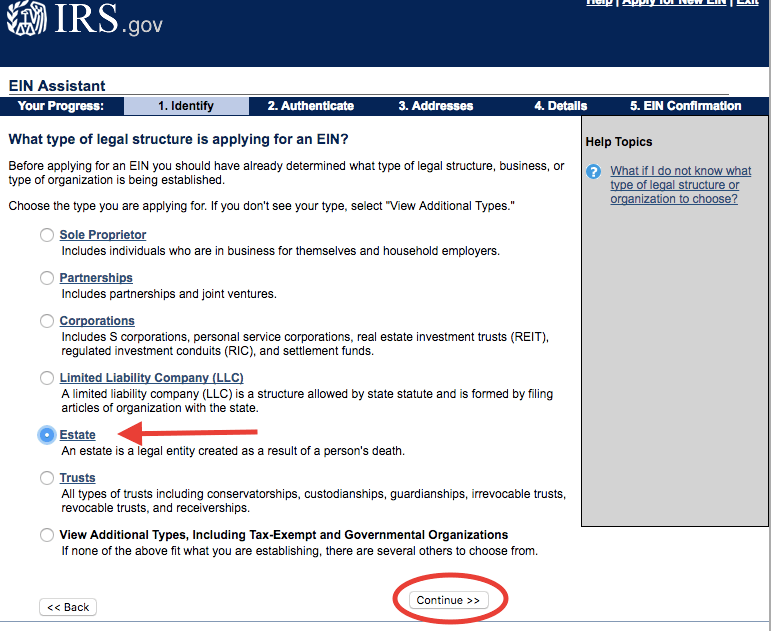

1. How to Apply for EIN Online (Fastest Method)

- Processing Time: Instant

- Availability: Monday to Friday, 7 a.m. to 10 p.m. Eastern Time

Steps:

- Go to the IRS EIN Application page

- Complete your application in one session (it times out after 15 minutes)

- Your EIN is issued immediately

Note: Online applications are only available for entities with a U.S. principal location. You must have a valid SSN or ITIN to apply.

2. Fax Application

- Processing Time: Up to 4 business days

Steps:

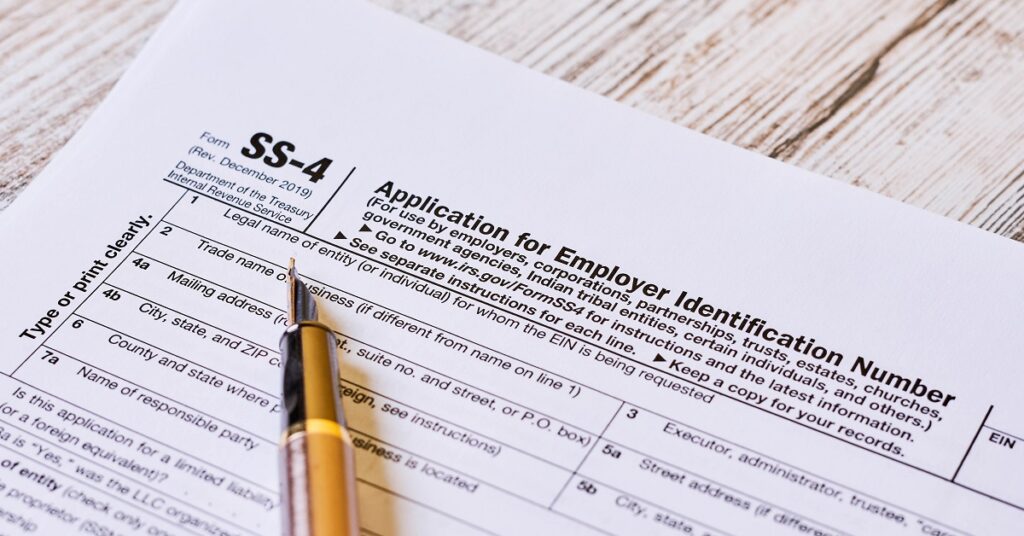

- Complete Form SS-4

- Fax it to (855) 641-6935 (U.S.) or (304) 707-9471 (International)

- Receive your EIN by fax within four days, if you provide a return number

3. Mail Application

- Processing Time: 3 to 4 weeks

Steps:

- Complete Form SS-4

- Mail it to:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

This is the slowest method, so avoid it if you’re on a deadline.

4. Phone Application (International Only)

- Processing Time: Immediate (during the call)

Steps:

- Call 267-941-1099 (not toll-free)

- Available Monday to Friday, 6 a.m. to 11 p.m. ET

- Provide all information from Form SS-4 to the IRS agent

- Get your EIN before the call ends

This method is ideal for non-U.S. residents wondering how to get an EIN for my LLC without access to other application options.

How Long Does It Take to Get an EIN?

The processing time depends on your application method:

| Method | Processing Time | Best For |

|---|---|---|

| Online | Instant | Fastest and most convenient option |

| Fax | 4 business days | Paper filers who need a quicker option |

| 3–4 weeks | Applicants without internet or fax access | |

| Phone (Intl.) | Instant (during call) | Non-U.S. entities and foreign applicants |

Still wondering how to get an EIN for my LLC in the fastest way? The online method is your best bet, as long as you meet the eligibility requirements.

What Can Delay EIN Processing?

While it’s easy to understand how to get an EIN for my LLC, delays can still occur. Common causes include:

- Incomplete or incorrect Form SS-4

- Missing required signatures or information

- Technical issues on the IRS site

- High volume during tax season

- Incorrect method for your business type (especially for foreign applicants)

Always review your application and make sure the “responsible party” listed has a valid SSN or ITIN.

How to Get a Tax ID Number for an LLC: Key Considerations

If you’re forming a U.S.-based LLC, it’s important to know how to get a Tax ID number. The EIN serves as that ID. Whether you’re starting a single-member or multi-member LLC, the EIN application is the same.

Tip: Apply for your EIN before opening a business bank account, hiring staff, or filing business taxes. Timing matters.

How Do I Get My EIN Number? (Checking Status)

Here’s how you can check the status of your EIN application:

- Online: Confirmation is shown instantly and a downloadable PDF is provided

- Fax: Call the IRS after 4 business days if nothing is received

- Mail: Wait 4+ weeks before contacting the IRS

- Phone: Number is issued during the call (international only)

If you lose the confirmation, you can request a verification letter (147C) from the IRS by calling them directly.

Can I Get an EIN on the Weekend?

Yes, you can fill out the online EIN form on weekends. However, the IRS system only processes applications Monday to Friday during business hours. Submissions over the weekend will be queued until the next working day.

Can You Reuse an EIN?

No. Each EIN is uniquely tied to a specific business entity. You cannot reuse an EIN if your business structure or ownership significantly changes. If you convert from a sole proprietorship to an LLC, you’ll likely need a new EIN.

How long does it take to get an EIN?

It can be instant if applied online, 4 business days by fax, or up to 4 weeks by mail.

How long does it take to get an EIN number from the IRS?

Online applications are processed immediately. Other methods take longer depending on the format.

How long does it take to get a tax ID for a business?

It depends on your method. Online is instant; fax takes about 4 days; mail takes 3–4 weeks.

How do I apply for an EIN online?

Visit the IRS website, complete the application in one session, and receive your EIN immediately.

How do I apply for a federal EIN number?

You can apply online, by fax, by mail, or by phone (for international applicants).

How to get an EIN for my LLC?

Apply via the IRS website using your SSN or ITIN. Online is the fastest and most efficient method.

Can I get an EIN without a Social Security Number?

Yes, non-U.S. residents can apply using an ITIN or by calling the IRS if they don’t have an SSN.

Final Thoughts on How to Get an EIN for My LLC

Knowing how to get an EIN for my LLC is a foundational step toward establishing your business legally in the U.S. While the process is simple, choosing the right method can save time. If you have internet access and meet IRS criteria, apply online—it’s quick and easy.

Whether you’re forming a new LLC, nonprofit, or startup, don’t delay getting your EIN. Prepare your documents early and follow the steps outlined in this guide.

Need help with the EIN process or forming your U.S. business? Contact our team for personalized assistance. We’ll guide you from start to finish to ensure your LLC is properly set up and compliant.